Providers face a fragmented market, lack EHR integration and need better charge capture

After hearing from many customers and reading numerous articles about the unprecedented growth of telehealth resulting from the COVID-19 pandemic, we were curious to dig deeper – to learn what technology and platforms providers are using, for what types of care and how they’re billing. In July 2020, we conducted a survey of hospital and physician practice leaders.

Some of the insights we uncovered were the fragmentation of the provider platform. While Zoom dominates the patient-facing side; providers today are using telehealth for three to four types of services, chiefly office visits and follow-up care. Additionally, it is clear telehealth usage is growing, but more integration of this care delivery vehicle with clinical information and billing systems is needed to ensure that providers can deliver optimal care while accurately charging for their services.

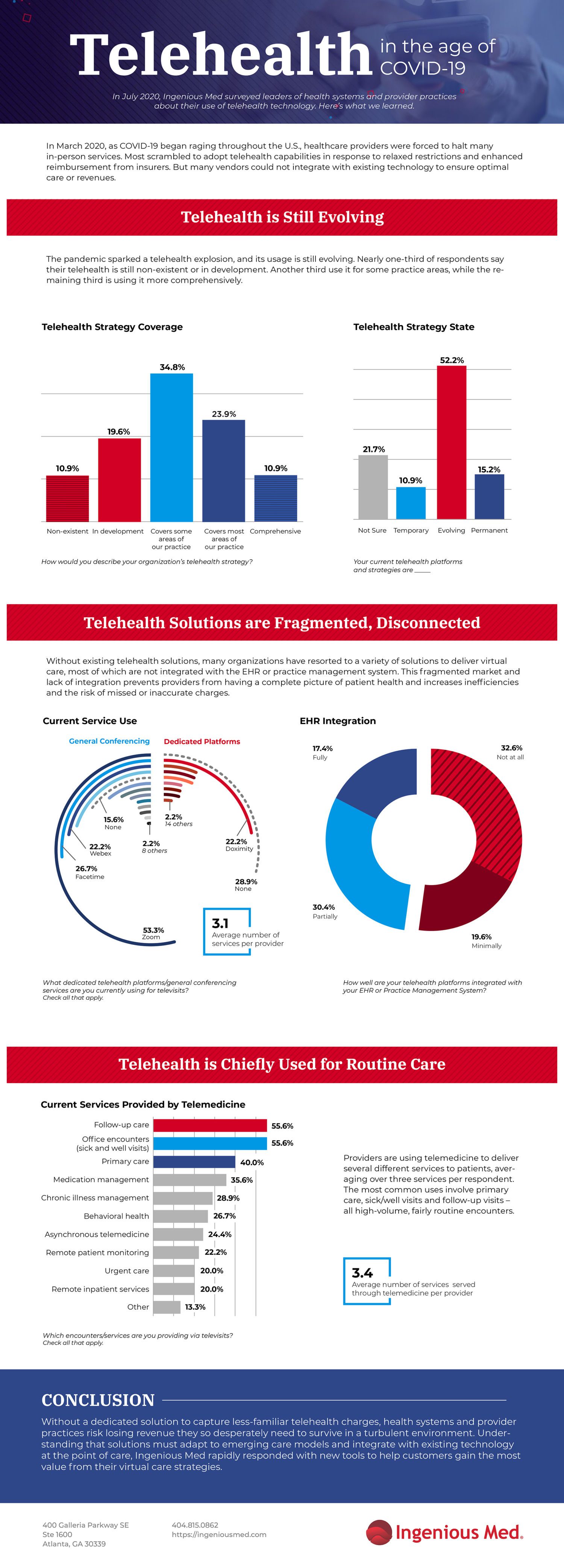

While telehealth is clearly growing, only about a third (35 percent) of respondents use it for most services or comprehensively.

Nearly a third (30 percent) lack any telehealth capabilities or say it’s in development. Another third use it for some, but not most, services.

The telehealth market is highly fragmented.

Over one quarter (29 percent) have no telehealth platform, and the lead vendor, Doximity, has only a 22 percent market share. Other vendors have single-digit market share: Teladoc was second at 7 percent while AmWell, Vivify and InTouch tied for third at 4 percent. MDLive, Philips and SnapMD each have 2 percent of the market.

On average, respondents use two devices for telehealth, with phones and computers used most often.

Tablets are also used by more than half. Phones represent a low-tech way for patients to receive care, but lack the ability to provide key visual information that could be essential to optimal care.

Most telehealth platforms are not well-integrated with EHRs or practice management systems.

One third are not integrated at all, 20 percent are minimally integrated, 30 percent are partly integrated and only 17 percent are fully integrated. This lack of integration presents a significant hurdle to providers seeking to deliver informed care virtually, as providers then lack the ability to easily view and assimilate a complete picture of the patient’s health. It also means more work for providers, who must toggle back and forth between platforms.

On the patient-facing side, the video conferencing service market is less fragmented.

Zoom is the dominant platform, with over half of the market using it to connect with patients. Facetime is second with over a quarter using it, followed closely by WebEx and Skype (22 and 20 percent, respectively). The rise of these platforms, as long as they are delivering on their promise to keep sensitive patient data safe, has both been fueled by and contributed to the demand for telehealth services, as they make it easier for patients to connect with their providers virtually.

On average, respondents are using telehealth for more than three types of services

It’s chiefly being used for non-urgent outpatient care. The top uses of telehealth are office encounters and follow-up care (56 percent each), followed by primary care, medication management, management of chronic conditions and behavioral health. Only two in 10 say they use telehealth for remote inpatient services or urgent care.

Providers are conducting the majority of telehealth visits from home (52 percent) or the office (61 percent).

Slightly less than half are from a clinic, and less than a third are conducted from a hospital. This underscores the need for providers to have telehealth technology that readily integrates remotely with the EHR and to have mobile charge capture systems that can be accessed easily anywhere the provider may be located.

In April, MGMA reported that physician practice revenues dropped an average of 55 percent, while the AHA estimated that U.S. hospitals will lose over $320 billion this year. While some volumes are returning, infection rates are rising rather than abating across much of the country. This puts healthcare at ongoing risk of continuing losses.

With a minority of providers reporting that they use a dedicated solution to capture these less-familiar telehealth charges, they are likely to lose some or much of the revenue they so desperately need in this challenging era. That’s why Ingenious Med quickly added a telemedicine modifier to all client environments for immediate use in charge capture workflows, enabling providers to correctly code encounters conducted via videoconference or other virtual encounter platforms for patient record and billing systems. We also created an optional telemedicine-specific superbill. Using a dedicated platform like Ingenious Med to fully, easily and accurately capture these charges can make or break the precarious financial health of a healthcare entity.