By Laura Chapman, VP, Product Management

Most health systems are moving to consolidate many of their EHRs in a single system. Epic and Cerner combined have an overall inpatient market share of 54 percent (for large hospitals, their combined share grows to 85 percent). That means these hospitals have no interoperability issues and need no additional technology solutions, right?

If only it were that simple… and in healthcare, nothing ever is. Instead, we continually hear from health systems that complementary software services are needed desperately – and will continue to be for the foreseeable future.

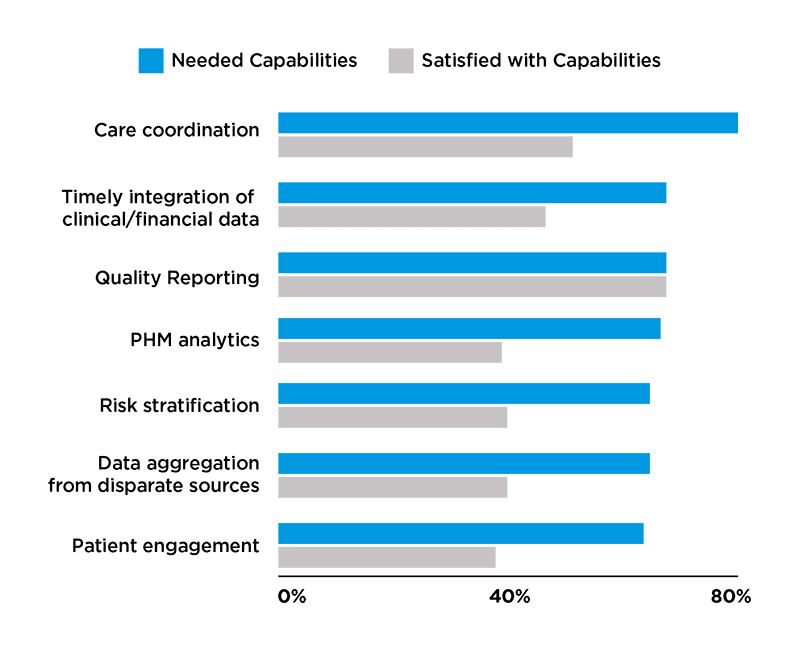

First, there’s no question that EHRs perform certain functions extremely well and are the backbone of the healthcare digital world. However, there are many functions they weren’t designed to manage. For example, a Sage Growth Partners 2018 survey (Graph 1) found high dissatisfaction with care coordination and timely integration of clinical and financial data. Because EHRs are largely clinically focused, many healthcare systems want to extend their capabilities with third-party business and performance analytics.

Graph 1: Value-Based Care Capabilities EHRs Lack

Source: Are EHRs Up to the Task?; Sage Growth Partners, Feb. 2018

Fragmentation beyond hospital walls

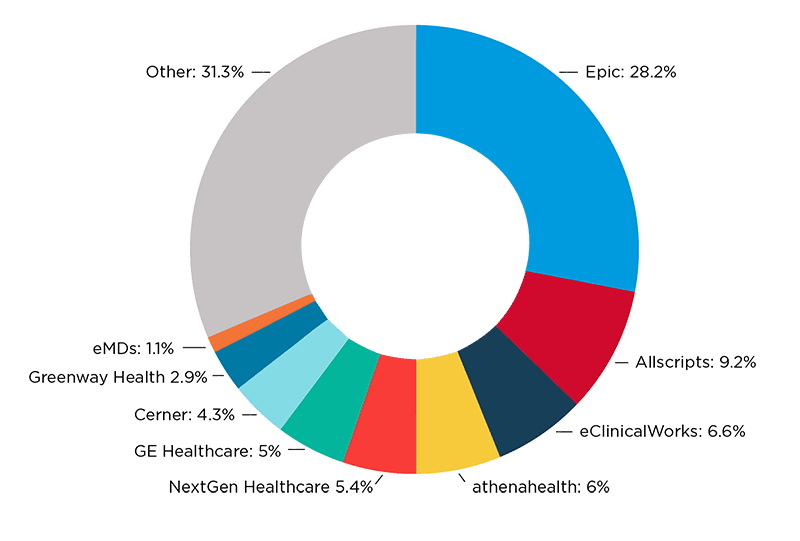

Second, communicating beyond the inpatient setting and owned practices continues to be a challenge. A 2018 Deloitte survey found that, unchanged from 2016, 62 percent of respondents continue to bemoan the lack of EHR interoperability. The outpatient market is far more fragmented than the inpatient market, as shown in Graph 2 (most vendors have less than a 10 percent market share.) That makes communication with affiliated physicians an ongoing nightmare for many health systems.

Worse, the post-acute market, which has not benefited from the same monetary incentives to adopt electronic records, lags far behind the acute care market. In 2016, only 64 percent of skilled nursing facilities had a commercial EHR and less than a third could exchange electronic data.

As providing care outside hospital walls becomes more important, the challenges of connecting care with these outpatient and post-acute providers becomes more… well, acute. Because EHRs don’t extend beyond the point of installation, they don’t readily support value-based care initiatives, leaving room for other purpose-built solutions.

Graph 2: Outpatient EHR Market Share

Source: EHR Products Used for Meaningful Use Attestation. HealthIT.gov

Webinar poll results

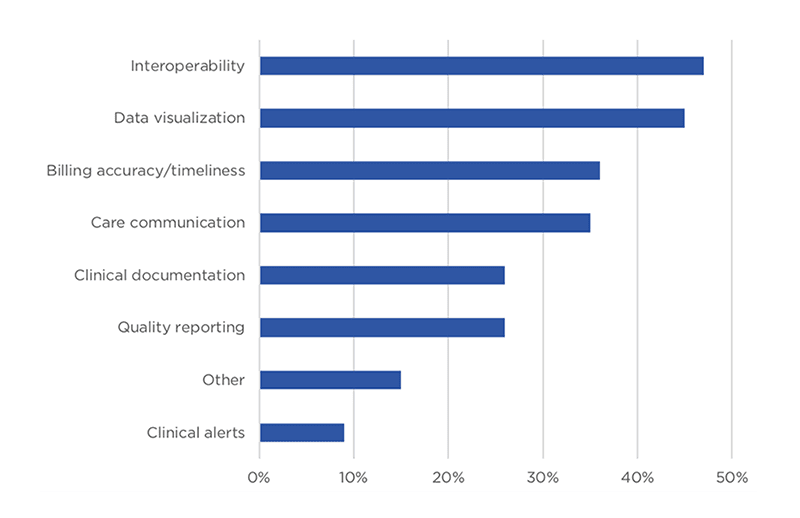

In our recent webinar “Optimize Performance and Value by Extending Your EHR,” a senior executive at Scripps Health provided real-world examples of EHR value and limitations. He described how Scripps is leveraging data analytics and reporting to supplement their EHR’s clinical capabilities with more robust business and performance analytics.

During the webinar, participants shared their top challenges that EHRs aren’t meeting today. Graph 3 shows the results of this poll question. Interoperability, data visualization and billing accuracy/timeliness were the top three unmet needs.

Graph 3: Biggest Challenges Not Addressed by EHRs

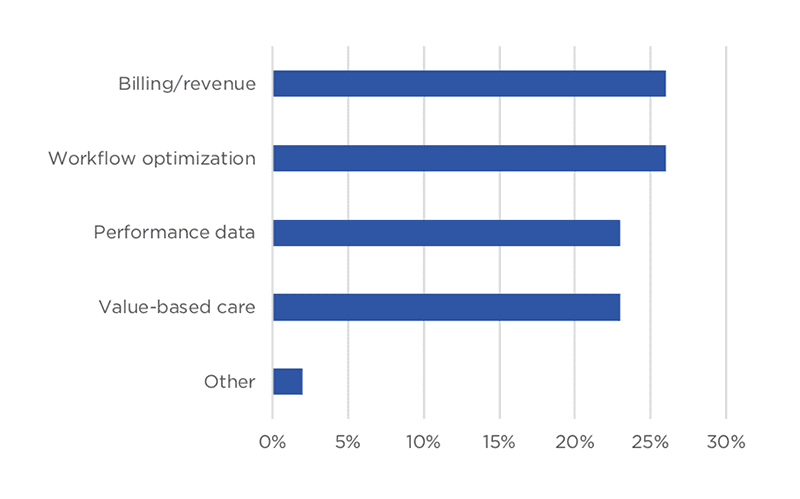

We also asked participants what single area most needed an outside vendor to complement their EHR’s functionalities. The results, shown in Graph 4, were nearly evenly spread across billing/revenue, performance data, value-based care and workflow optimization. That indicates that there are quite a number of key functions where health systems need third-party solutions to meet their needs.

Graph 4: Areas that Most Need Outside Vendor to Complement EHR

Critical business and physician performance analytics needed

The bottom line is that EHRs do well in clinical domain and will continue to focus on tracking patient and hospital clinical information. But they aren’t delivering all the critical business and physician performance metrics that are so important to cost management.

As hospitals go through the different maturity stages of EHR adoption, they need different strategies for each stage. Most aren’t as satisfied with their EHR capabilities as they expected to be; they’re learning that they need to make judicious choices about which software as a service (SaaS) solutions they should keep, toss or buy to ensure they’re growing revenue, managing costs and helping physicians provide optimal care and value. Having robust revenue capture tools and business analytics is critical, especially given the current level of M&A activity and consolidation in the industry.

With the emergence of a more powerful healthcare consumer, interoperability becomes a key component of their service expectations. Ultimately, depending on the EHR alone challenges health systems to sufficiently optimize revenues, obtain timely data intelligence or align their services with value-based care models.

Want to see more? You can find our other blogs here.

Don’t miss out on our next blog! Subscribe here.